Multiple Choice

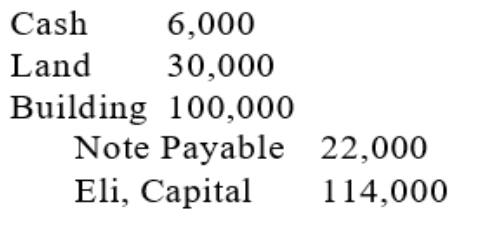

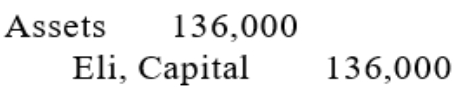

Eli opened a new business by investing the following assets: cash, $6,000; land,$30,000; building, $100,000. Also, the business will assume responsibility for a notepayable of $22,000. Eli signed the note as part of his payment for the land and building. Which journal entry should be used on the books of the new business to record theinvestment by Eli?

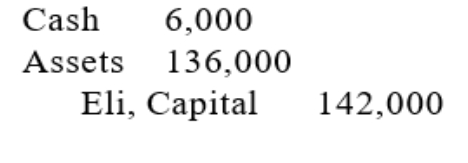

A)

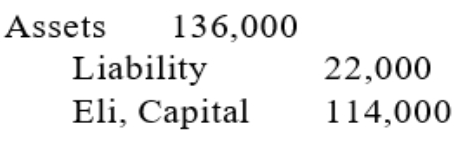

B)

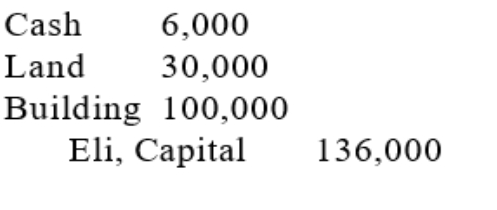

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The accounting cycle begins with<br>A)Posting to the

Q5: Cash withdrawn by the owner of an

Q5: The right side of a T-account is

Q6: A column in journals and accounts used

Q8: Green's Book Store purchased a new automobile

Q10: To make it easier for the bookkeeper,

Q13: Indicate whether a debit or a credit

Q14: A building is an example of an

Q14: If, on a trial balance, the total

Q17: A compound journal entry usually affects three