Multiple Choice

Table 17-5

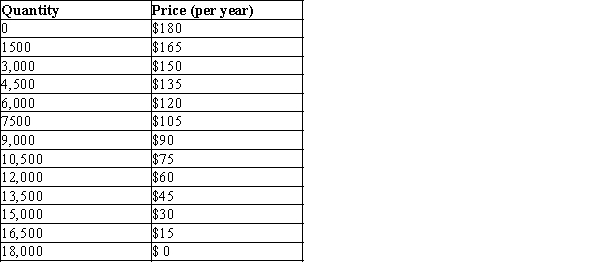

The information in the table below shows the total demand for premium-channel digital cable TV subscriptions in a small urban market. Assume that each digital cable TV operator pays a fixed cost of $200,000 (per year) to provide premium digital channels in the market area and that the marginal cost of providing the premium channel service to a household is zero.

-Refer to Table 17-5. Assume that there are two profit-maximizing digital cable TV companies operating in this market. Further assume that they are not able to collude on the price and quantity of premium digital channel subscriptions to sell. How much profit will each firm earn when this market reaches a Nash equilibrium?

A) $25,000

B) $90,000

C) $160,000

D) $215,000

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The problems faced by oligopolies with three

Q75: If duopolists colluded but then stopped colluding,<br>A)price

Q78: In a duopoly situation, the logic of

Q79: Table 17-21<br>The Chicken Game is named for

Q81: Table 17-1<br>Imagine a small town in which

Q82: If nations such as Germany, Japan, and

Q83: Assuming that oligopolists do not have the

Q85: The manufacturer of South Face sells jackets

Q111: Cartels with a small number of firms

Q188: Define collusion.