Multiple Choice

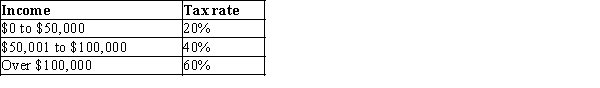

Table 12-5

-Refer to Table 12-5. What is the marginal tax rate for a person who makes $60,000?

A) 20%

B) 23%

C) 40%

D) 45%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q40: Define the marginal tax rate.

Q70: In 2014, what were the two largest

Q128: What is the current, annual, approximate amount

Q170: One reason that deadweight losses are so

Q197: The income tax requires that taxpayers pay

Q224: If a poor family has three children

Q271: If a tax takes a smaller fraction

Q421: A person's average tax rate equals her<br>A)tax

Q422: The largest source of federal revenue in

Q425: Under a regressive tax system, the marginal