Multiple Choice

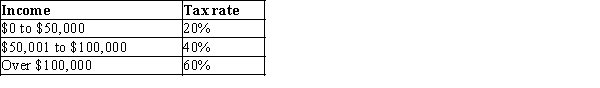

Table 12-5

-Refer to Table 12-5. What is the marginal tax rate for a person who makes $120,000?

A) 25%

B) 35%

C) 45%

D) 60%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q139: Income taxes and property taxes generate the

Q234: Scenario 12-2<br>Suppose that Bob places a value

Q235: You are trying to design a tax

Q236: Table 12-9<br>United States Income Tax Rates for

Q237: Scenario 12-1<br>Ken places a $20 value on

Q239: In which of the following tax systems

Q241: Table 12-8<br>The following table presents the total

Q242: Table 12-9<br>United States Income Tax Rates for

Q243: One advantage of a lump-sum tax over

Q340: The benefits principle is used to justify<br>A)sales