Multiple Choice

Table 12-6

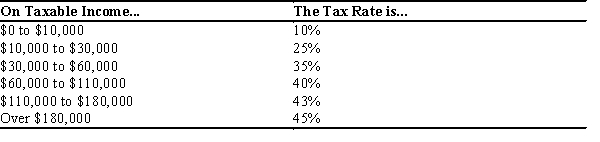

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-6. For this tax schedule, what is the marginal tax rate for an individual with taxable income of $49,000?

A) 0%

B) 10%

C) 25%

D) 35%

Correct Answer:

Verified

Correct Answer:

Verified

Q78: Revenues from social insurance taxes are earmarked

Q184: The argument that each person should pay

Q545: Horizontal equity in taxation refers to the

Q546: Which of the following is an example

Q547: Suppose a state has the following individual

Q549: Individual Retirement Accounts and 401(k) plans make

Q551: A person's tax obligation divided by her

Q552: Table 12-17<br>The following table shows the marginal

Q553: Scenario 12-4<br>A taxpayer faces the following tax

Q554: Which of the following is not an