Multiple Choice

Table 12-6

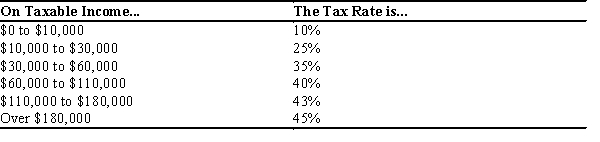

The table below shows the marginal tax rates for an unmarried taxpayer for various levels of taxable income.

-Refer to Table 12-6. For this tax schedule, what is the average tax rate for an individual with $49,000 in taxable income?

A) 25.8%

B) 27.5%.

C) 40.0%

D) 43.7%

Correct Answer:

Verified

Correct Answer:

Verified

Q53: Which tax system requires higher-income taxpayers to

Q54: Table 12-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-22

Q58: Scenario 12-5<br>Senator Filch argues that a tax

Q59: Scenario 12-4<br>A taxpayer faces the following tax

Q60: Changing the basis of taxation from income

Q61: Who observed that "in this world nothing

Q62: In 1789, the average American paid approximately

Q85: Corporate income taxes are based on the

Q136: Some states do not have a state

Q443: A tax that is higher for men