Multiple Choice

Table 12-7

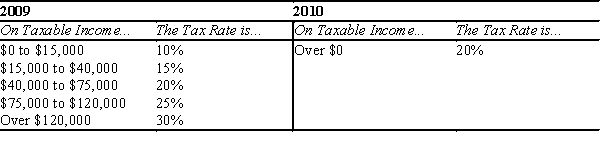

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-7. For an individual who earned $80,000 of taxable income in 2009, what was the individual's average tax rate in 2009?

A) 12.7%

B) 15.0%

C) 16.1%

D) 16.9%

Correct Answer:

Verified

Correct Answer:

Verified

Q34: A person's marginal tax rate equals<br>A)her tax

Q167: If all taxpayers pay the same percentage

Q205: Briefly describe why taxes create deadweight loss.

Q206: Table 12-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-22

Q216: Karole's income rises from $50,000 to $75,000

Q405: Total taxes paid divided by total income

Q407: Part of the deadweight loss from taxing

Q410: Table 12-8<br>The following table presents the total

Q412: Who pays a corporate income tax?<br>A)owners of

Q413: In order to construct a more complete