Multiple Choice

Table 12-7

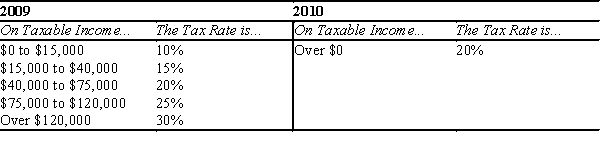

The following table shows the marginal tax rates for unmarried individuals for two years.

-Refer to Table 12-7. For an individual who earned $35,000 in taxable income in both years, which of the following describes the change in the individual's average tax rate between the two years?

A) The average tax rate increased from 2009 to 2010.

B) The average tax rate decreased from 2009 to 2010.

C) The average tax rate remained constant from 2009 to 2010.

D) The change in the average tax rate cannot be determined for the two tax schedules shown.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Many economists believe that the U.S. tax

Q118: One of the most difficult issues associated

Q154: If we want to gauge how much

Q239: In which of the following tax systems

Q267: Table 12-2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-2

Q270: Table 12-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-1

Q271: If a tax takes a smaller fraction

Q273: Table 12-9<br>United States Income Tax Rates for

Q275: In 2010, the co-chairmen of President Obama's

Q276: Table 12-12 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-12