Multiple Choice

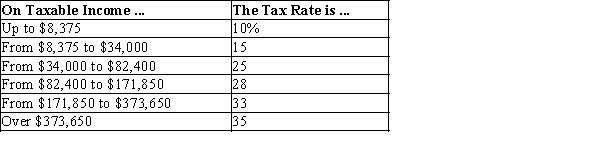

Table 12-10

-Refer to Table 12-10. If Miss Kay has $80,000 in taxable income, her marginal tax rate is

A) 15%.

B) 25%.

C) 28%.

D) 33%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q32: Suppose the government taxes 10 percent of

Q53: Which tax system requires higher-income taxpayers to

Q84: Lump-sum taxes are equitable but not efficient.

Q130: Horizontal equity refers to a tax system

Q199: Sales taxes generate nearly 50% of the

Q212: Table 12-25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-25

Q213: The theory that the wealthy should contribute

Q216: If the government imposes a tax of

Q218: You are trying to design a tax

Q219: An efficient tax system is one that