Multiple Choice

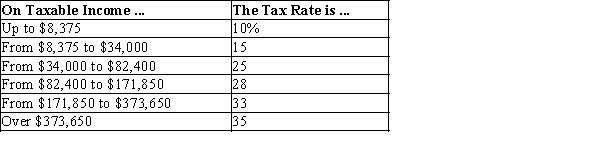

Table 12-10

-Refer to Table 12-10. If Willie has $170,000 in taxable income, his marginal tax rate is

A) 25%.

B) 28%.

C) 33%.

D) 35%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q171: Suppose New York City passes a local

Q196: Suppose the government imposes a tax of

Q491: Suppose the government imposes a tax of

Q494: "A $1,000 tax paid by a poor

Q495: Table 12-6<br>The table below shows the marginal

Q497: Table 12-9<br>United States Income Tax Rates for

Q498: The principle that people should pay taxes

Q499: The federal government decides to impose a

Q500: Table 12-6<br>The table below shows the marginal

Q501: Scenario 12-1<br>Ken places a $20 value on