Multiple Choice

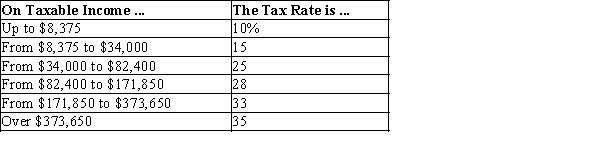

Table 12-10

-Refer to Table 12-10. If Si has $100,000 in taxable income, his tax liability will be

A) $838.

B) $3,844.

C) $12,100.

D) $21,709.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q110: A consumption tax is a tax on<br>A)goods

Q168: Table 12-14 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-14

Q169: Table 12-20<br>The following table presents the total

Q171: Suppose New York City passes a local

Q174: When a tax is justified on the

Q175: 'The U.S. tax code gives preferential treatment

Q223: List several examples of the administrative burden

Q352: Scenario 12-5<br>Senator Filch argues that a tax

Q505: Which of the following statements is not

Q560: Table 12-15 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-15