Multiple Choice

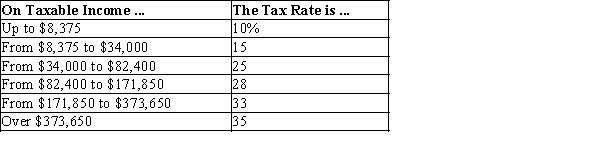

Table 12-10

-Refer to Table 12-10. If Jace has $33,000 in taxable income, his average tax rate is

A) 13.7%.

B) 14.6%.

C) 15.0%.

D) 15.2%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q156: What is the most efficient tax and

Q435: Which tax system requires all taxpayers to

Q436: The flypaper theory of tax incidence<br>A)ignores the

Q437: Scenario 12-3<br>Suppose Roger and Regina receive great

Q438: Table 12-10 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-10

Q441: Table 12-21<br>The dollar amounts in the last

Q442: Table 12-18<br>United States Income Tax Rates for

Q443: A tax that is higher for men

Q444: The most efficient tax possible is a<br>A)marginal

Q445: When the marginal tax rate equals the