Multiple Choice

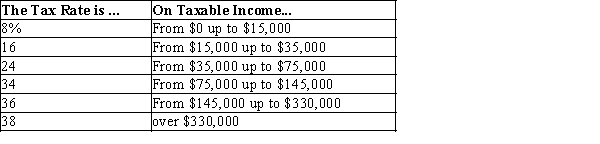

Table 12-11

-Refer to Table 12-11. If Al has taxable income of $165,000, his marginal tax rate is

A) 16%.

B) 24%.

C) 34%.

D) 36%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: What are the two main sources of

Q26: Suppose the government imposes a tax of

Q93: Individual income taxes generate roughly 25% of

Q135: When the government levies a tax on

Q168: Table 12-14 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Table 12-14

Q169: Table 12-20<br>The following table presents the total

Q186: A lump-sum tax minimizes deadweight loss.

Q257: Table 12-23<br>The dollar amounts in the last

Q260: European countries tend to rely on which

Q263: Which tax system requires higher-income taxpayers to