Multiple Choice

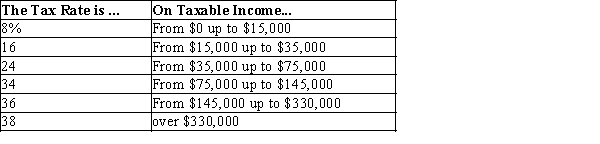

Table 12-11

-Refer to Table 12-11. If Peggy has taxable income of $43,000, her average tax rate is

A) 14.7%.

B) 16.3%.

C) 20.8%.

D) 24.0%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q77: If a tax generates a reduction in

Q112: Deadweight losses are associated with<br>A) taxes that

Q171: Suppose New York City passes a local

Q187: If we want to gauge the sacrifice

Q188: If revenue from a gasoline tax is

Q196: Suppose the government imposes a tax of

Q485: A lump-sum tax<br>A)is most frequently used to

Q491: Suppose the government imposes a tax of

Q494: "A $1,000 tax paid by a poor

Q495: Table 12-6<br>The table below shows the marginal