Multiple Choice

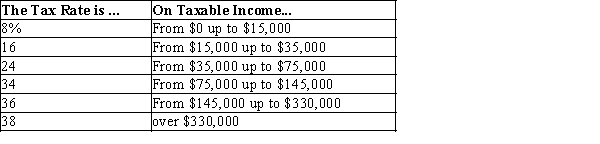

Table 12-11

-Refer to Table 12-11. If Peggy has taxable income of $43,000, her marginal tax rate is

A) 8%.

B) 16%.

C) 24%.

D) 34%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q50: The notion that similar taxpayers should pay

Q62: If your income is $40,000 and your

Q166: Rob's income rises from $50,000 to $60,000

Q174: When a tax is justified on the

Q186: Table 12-21<br>The dollar amounts in the last

Q435: Which tax system requires all taxpayers to

Q526: Today the typical American pays approximately what

Q529: Goals of efficiency and equity in tax

Q530: Suppose Darby values a certain smart phone

Q531: The income tax requires that taxpayers pay