Multiple Choice

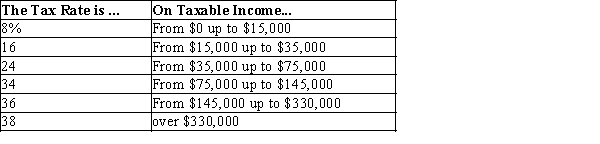

Table 12-11

-Refer to Table 12-11. If Bud has taxable income of $78,000, his average tax rate is

A) 18.7%.

B) 19.3%.

C) 20.1%.

D) 34.0%.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: What are the characteristic(s) of an efficient

Q10: The claim that all citizens should make

Q13: As a person's or family's income rises,

Q14: If tax revenues from a cigarette tax

Q20: Economics alone cannot determine the best way

Q71: Suppose Luke values a scoop of Italian

Q74: The average American pays a higher percent

Q77: An income tax in which the average

Q78: Table 12-9<br>United States Income Tax Rates for

Q132: An excise tax is a tax on