Multiple Choice

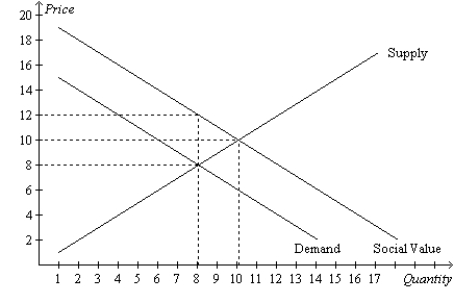

Figure 10-8

-Refer to Figure 10-8. If the government wanted to tax or subsidize this good to achieve the socially-optimal level of output, it would

A) introduce a subsidy of $2 per unit.

B) impose a tax of $2 per unit.

C) introduce a subsidy of $4 per unit.

D) impose a tax of $4 per unit.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: The concept of external benefit is associated

Q78: Which of the following statements is not

Q91: The government can internalize externalities by taxing

Q104: Some government policies provide incentives for private

Q111: Suppose the socially-optimal quantity of good x

Q289: Technology spillover is one type of<br>A)negative externality.<br>B)positive

Q292: A negative externality<br>A)is an adverse impact on

Q294: A negative externality arises when a person

Q297: Table 10-5<br>The following table shows the marginal

Q298: Figure 10-20. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1273/.jpg" alt="Figure 10-20.