Multiple Choice

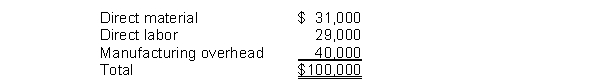

Mallory Company manufactures widgets. Bowden Company has approached Mallory with a proposal to sell the company widgets at a price of $80,000 for 100,000 units. Mallory is currently making these components in its own factory. The following costs are associated with this part of the process when 100,000 units are produced:  The manufacturing overhead consists of $16,000 of costs that will be eliminated if the components are no longer produced by Mallory. From Mallory's point of view, how much is the incremental cost or savings if the widgets are bought instead of made?

The manufacturing overhead consists of $16,000 of costs that will be eliminated if the components are no longer produced by Mallory. From Mallory's point of view, how much is the incremental cost or savings if the widgets are bought instead of made?

A) $20,000 incremental savings

B) $4,000 incremental cost

C) $4,000 incremental savings

D) $20,000 incremental cost

Correct Answer:

Verified

Correct Answer:

Verified

Q126: Incremental analysis is most useful<br>A) in developing

Q157: The annual rate of return is computed

Q181: Each of the following is a disadvantage

Q186: Opportunity cost is usually<br>A) a standard cost.<br>B)

Q210: Bell's Shop can make 1,000 units of

Q211: Using the net present value method, the

Q212: Use the following table, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3107/.jpg" alt="Use

Q213: Moreland Clean Company spent $4,000 to produce

Q214: A segment has the following data: <img

Q217: It costs Dryer Company $26 per unit