Multiple Choice

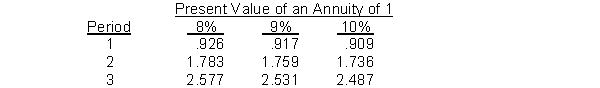

Use the following table,  A company has a minimum required rate of return of 8% and is considering investing in a project that costs $68,337 and is expected to generate cash inflows of $27,000 each year for three years. The approximate internal rate of return on this project is

A company has a minimum required rate of return of 8% and is considering investing in a project that costs $68,337 and is expected to generate cash inflows of $27,000 each year for three years. The approximate internal rate of return on this project is

A) 8%.

B) 9%.

C) 10%.

D) less than the required 8%.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Aaron Co. is considering purchasing a new

Q14: Kinder Enterprises relies heavily on a copier

Q16: Finney Company estimates the following cash flows

Q17: Which of the following is a true

Q18: Fehr Company is considering two capital investment

Q20: New Age Makeup produces face cream. Each

Q39: Which of the following is not a

Q169: The focus of a sell or process

Q176: Which one of the following is correct?<br>A)

Q197: An opportunity cost is the potential benefit