Essay

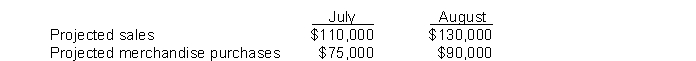

Molina, Inc. provided the following information:

Molina estimates that it will collect 40% of its sales in the month of sale, 35% in the month after the sale, and 22% in the second month following the sale. Three percent of all sales are estimated to be bad debts.

Molina pays 30% of merchandise purchases in the month purchased and 70% in the following month.

General operating expenses are budgeted to be $20,000 per month of which depreciation is $2,000 of this amount. Molina pays operating expenses in the month incurred.

Molina makes loan payments of $3,000 per month of which $400 is interest and the remainder is principal.

Instructions

Calculate Molina's budgeted cash disbursements for August.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: A purchases budget is used instead of

Q80: Long-range plans are used more as a

Q82: In a production budget, total required units

Q84: Berry Company manufactures two products, (1) Regular

Q89: The following credit sales are budgeted by

Q91: Zimmer Company reported the following information

Q92: Giles Company is preparing its direct labor

Q126: Which of the following is done to

Q167: Which of the following does not appear

Q168: The budgeted income statement indicates the expected