Essay

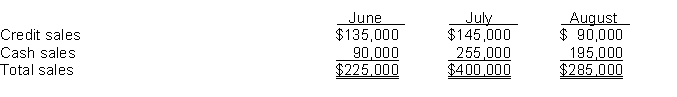

Dalton Company has budgeted sales revenues as follows:

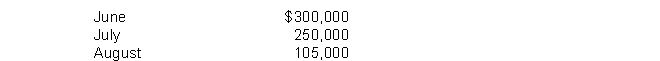

Past experience indicates that 60% of the credit sales will be collected in the month of sale and the remaining 40% will be collected in the following month. Purchases of inventory are all on credit and 50% is paid in the month of purchase and 50% in the month following purchase. Budgeted inventory purchases are:

Other cash disbursements budgeted: (a) selling and administrative expenses of $48,000 each month, (b) dividends of $103,000 will be paid in July, and (c) purchase of equipment in August for $30,000 cash.

The company wishes to maintain a minimum cash balance of $50,000 at the end of each month. The company borrows money from the bank at 8% interest if necessary to maintain the minimum cash balance. Borrowed money is repaid in months when there is an excess cash balance. The beginning cash balance on July 1 was $50,000. Assume that borrowed money in this case is for one month.

Instructions

Prepare a cash budget for the months of July and August. Prepare separate schedules for expected collections from customers and expected payments for purchases of inventory.

Correct Answer:

Verified

*30,000 × 8% × 1/12...

*30,000 × 8% × 1/12...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Ferguson Inc. provided the following information:<br>

Q20: Wyatt Company has budgeted the following unit

Q22: Zimmer Company reported the following information

Q25: Swift, Inc. has budgeted its activity for

Q28: The following information is taken from the

Q65: A sales forecast<br>A) shows a forecast for

Q68: A budget is most likely to be

Q93: The direct materials budget is derived from

Q106: The budget itself and the administration of

Q160: A major difference between the annual budget