Multiple Choice

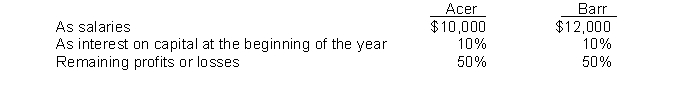

Partners Acer and Barr have capital balances in a partnership of $40,000 and $60,000, respectively. They agree to share profits and losses as follows:  If income for the year was $50,000, what will be the distribution of income to Barr?

If income for the year was $50,000, what will be the distribution of income to Barr?

A) $23,000

B) $27,000

C) $20,000

D) $10,000

Correct Answer:

Verified

Correct Answer:

Verified

Q12: If a partner's investment in a partnership

Q15: Partners Audrey, Betty, and Charles have capital

Q18: Match the items below by entering the

Q19: When a partner withdraws from the firm,

Q21: D. Dieker purchases a 25% interest for

Q39: The liquidation of a partnership means that

Q49: A general partner in a partnership<br>A) has

Q85: In an admission of a partner by

Q199: The admission of a new partner results

Q202: An interest allowance in sharing partnership net