Essay

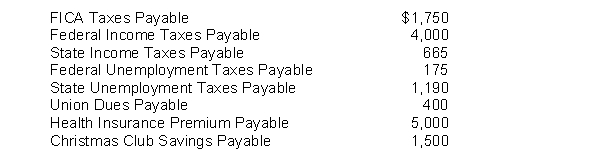

The following payroll liability accounts are included in the ledger of Eckstrom Company on January 1, 2010:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,750 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Sent a $1,500 check to a Savings and Loan for the Christmas Club withholdings.

Instructions

Journalize the January transactions

Correct Answer:

Verified

Correct Answer:

Verified

Q64: Working capital is<br>A) current assets plus current

Q75: FICA Taxes Payable was credited for $9,000

Q77: The interest charged on a $50,000 note

Q78: Valerie's Salon has total receipts for the

Q81: A company will incur product repair costs

Q83: In February, gross earnings in Wine Company

Q84: The entry to record the payment of

Q101: Liabilities are classified on the balance sheet

Q178: Warranty expenses are reported on the income

Q218: A contingency that is remote<br>A) should be