Essay

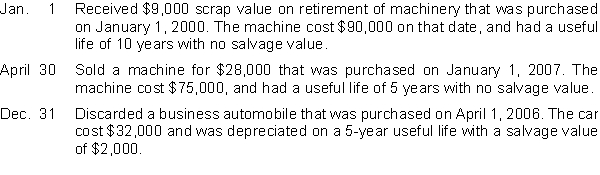

Presented below are selected transactions for Corbin Company for 2010.

Instructions

Journalize all entries required as a result of the above transactions. Corbin Company uses the straight-line method of depreciation and has recorded depreciation through December 31, 2009.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: A gain or loss on disposal of

Q12: If fully depreciated equipment that cost $10000

Q21: With the exception of land plant assets

Q51: The _ method of computing depreciation expense

Q171: If the proceeds from the sale of

Q213: On January 2, 2010, Harlan Company purchased

Q216: On July 1, 2010, Hale Kennels sells

Q217: Henson Company incurred $300,000 of research and

Q218: During the current year, Penny Company incurred

Q219: Neosho Mining invested $960,000 in a mine