Multiple Choice

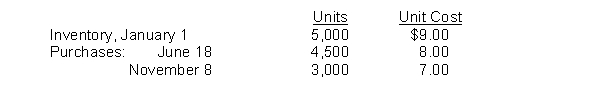

Holliday Company's inventory records show the following data:  A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for $12 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method.

A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for $12 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method.

Under the FIFO method, the December 31 inventory is valued at

A) $14,000.

B) $14,500.

C) $15,000.

D) $18,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: If companies have identical inventoriable costs but

Q27: Under the FIFO method the costs of

Q65: In applying the LIFO assumption in a

Q129: Inventoriable costs include all of the following

Q151: A company just starting business made the

Q155: Which of the following is not a

Q157: Graham Company uses a periodic inventory system.

Q158: Graham Company uses a periodic inventory system.

Q161: Flott Department Store prepares monthly financial statements

Q169: In a manufacturing company goods that are