Multiple Choice

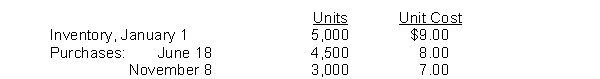

Holliday Company's inventory records show the following data:  A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for $12 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. Under the LIFO method, cost of goods sold is

A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for $12 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. Under the LIFO method, cost of goods sold is

A) $10,500.

B) $18,000.

C) $84,000.

D) $88,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q57: The lower-of-cost-or-market basis of accounting for inventories

Q71: The following information is available for Witten

Q72: Lee Industries had the following inventory transactions

Q72: Under the retail inventory method the estimated

Q73: Under the lower-of-cost-or-market basis in valuing inventory,

Q74: Kershaw Bookstore had 500 units on hand

Q75: In the first month of operations, Santos

Q77: Match the items below by entering the

Q78: Colletti Company recorded the following data: <img

Q123: If a company has no beginning inventory