Multiple Choice

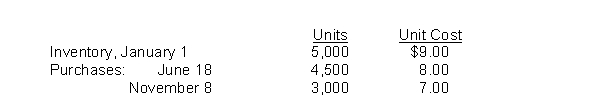

Holliday Company's inventory records show the following data:  A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for $12 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. What is the difference in taxes if LIFO rather than FIFO is used?

A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for $12 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. What is the difference in taxes if LIFO rather than FIFO is used?

A) $800 additional taxes

B) $3,200 tax savings

C) $4,000 tax savings

D) $4,000 additional taxes

Correct Answer:

Verified

Correct Answer:

Verified

Q20: The cost of goods available for sale

Q28: The specific identification method of inventory valuation

Q69: Under the gross profit method each of

Q71: If a company uses the FIFO cost

Q106: Finished goods are a classification of inventory

Q107: The accountant at Paige Company is figuring

Q110: The lower-of-cost-or-market (LCM) basis may be be

Q111: Of the following companies which one would

Q113: Rudolf Diesel Company's inventory records show the

Q116: The following information was available for Hoover