Multiple Choice

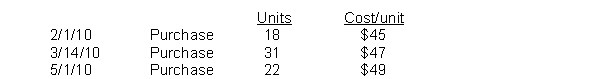

Lee Industries had the following inventory transactions occur during 2010:  The company sold 51 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using LIFO? (rounded to whole dollars)

The company sold 51 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using LIFO? (rounded to whole dollars)

A) $772

B) $848

C) $594

D) $540

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Goods out on consignment should be included

Q58: Ted's Used Cars uses the specific identification

Q59: Purdy Company is in the electronics industry

Q60: The inventory turnover ratio is computed by

Q61: A company just starting business made the

Q66: Companies adopt different cost flow methods for

Q147: Raw materials inventories are the goods that

Q162: The factor which determines whether or not

Q184: The specific identification method of costing inventories

Q213: Overstating ending inventory will overstate all of