Multiple Choice

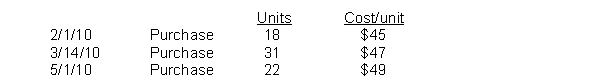

Lee Industries had the following inventory transactions occur during 2010:  The company sold 51 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 51 units at $63 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

A) $772

B) $848

C) $594

D) $540

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which of the following items will increase

Q101: Selection of an inventory costing method by

Q174: The managers of Mayo Company receive performance

Q175: A new average cost is computed each

Q178: Finch Company is preparing the annual financial

Q179: Linden Watch Company reported the following income

Q180: The pool of inventory costs consists of

Q181: The manager of Yates Company is given

Q182: The accountant at Reber Company has determined

Q188: If inventories are valued using the LIFO