Essay

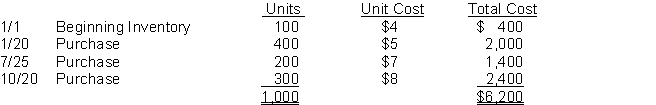

Clarke Company uses the periodic inventory method and had the following inventory information available:

A physical count of inventory on December 31 revealed that there were 400 units on hand.

Instructions

Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is $__________.

2. Assume that the company uses the Average-Cost method. The value of the ending inventory on December 31 is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is $__________.

4. Determine the difference in the amount of income that the company would have reported if it had used the FIFO method instead of the LIFO method. Would income have been greater or less?

Correct Answer:

Verified

1. FIFO: Ending inventory $3,100

2. A...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2. A...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Never Company developed the following information about

Q18: In a period of rising prices FIFO

Q20: Paulson, Inc. has 5 computers which have

Q23: Sawyer Company uses the perpetual inventory system

Q75: The specific identification method of costing inventories

Q76: In a period of increasing prices which

Q108: In a manufacturing business inventory that is

Q151: The consistent application of an inventory costing

Q201: Inventoriable costs are allocated to _ and

Q209: Inventories affect<br>A) only the balance sheet.<br>B) only