Short Answer

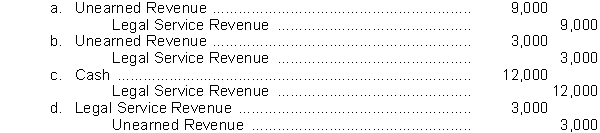

Mike Conway is a lawyer who requires that his clients pay him in advance of legal services rendered. Mike routinely credits Legal Service Revenue when his clients pay him in advance. In June Mike collected $12,000 in advance fees and completed 75% of the work related to these fees. What adjusting entry is required by Mike's firm at the end of June?

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Accounting time periods that are one year

Q66: Accumulated Depreciation is<br>A) an expense account.<br>B) an

Q68: The time period assumption states that the

Q91: An accounting period that is one year

Q107: The preparation of adjusting entries is<br>A) straight

Q115: Southwestern City College sold season tickets for

Q116: The matching principle attempts to match _

Q118: On January 1, 2010, Dimes and Quarters

Q119: Compute the net income for 2010 based

Q122: On January 2, 2010, National Credit and