Essay

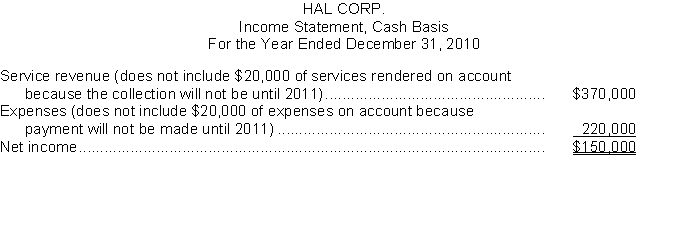

Hal Corp. prepared the following income statement using the cash basis of accounting:

Additional data:

1. Depreciation on a company automobile for the year amounted to $6,000. This amount is not included in the expenses above.

2. On January 1, 2010, paid for a two-year insurance policy on the automobile amounting to $1,800. This amount is included in the expenses above.

Instructions

(a) Recast the above income statement on the accrual basis in conformity with generally accepted accounting principles. Show computations and explain each change.

(b) Explain which basis (cash or accrual) provides a better measure of income.

Correct Answer:

Verified

(a)

Service revenue should include the...

Service revenue should include the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q107: The preparation of adjusting entries is<br>A) straight

Q108: The revenue recognition principle dictates that revenue

Q109: Prepare adjusting entries for the following transactions.

Q110: Instructions<br>Calculate the following for 2010:<br>1. Cash received

Q111: Which of the following statements concerning accrual-basis

Q112: On February 1, Results Income Tax Service

Q114: Southwestern City College sold season tickets for

Q115: Southwestern City College sold season tickets for

Q116: The matching principle attempts to match _

Q118: On January 1, 2010, Dimes and Quarters