Essay

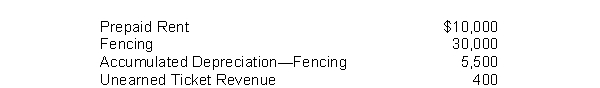

The Poway Animal Encounters operates a drive through tourist attraction. The company adjusts its accounts at the end of each month. The selected accounts appearing below reflect balances after adjusting entries were prepared on April 30. The adjusted trial balance shows the following:

Other data:

1. Three months' rent had been prepaid on April 1.

2. The fencing is being depreciated at $6,000 per year.

3. The unearned ticket revenue represents tickets sold for future visits. The tickets were sold at $4.00 each on April 1. During April, twenty of the tickets were used by customers.

Instructions

(a) Calculate the following:

1. Monthly rent expense.

2. The age of the fencing in months.

3. The number of tickets sold on April 1.

(b) Prepare the adjusting entries that were made by the Poway Animal Encounters on April 30.

Correct Answer:

Verified

(a) 1. $5,000. The $10,000 balance on th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: If prepaid expenses are initially recorded in

Q19: When a prepaid expense is initially debited

Q73: The adjusting entry at the end of

Q129: Ramona's Music School borrowed $20,000 from the

Q133: Cindi's Candies paid employee wages on and

Q135: Adjusting entries are required<br>A) because some costs

Q137: The adjusted trial balance of Hanson Hawk

Q143: The revenue recognition principle dictates that revenue

Q155: In a service-type business, revenue is considered

Q254: Expense recognition is tied to revenue recognition.