Essay

Westwood Gear, Inc., recently received a special order to manufacture 10,000 units for a Canadian company. This order specified that the selling price per unit should not exceed $50. Since the order was received without the effort of the sales department, no commission would be paid. However, an export handling charge of $5 per unit would be incurred. Management anticipates that acceptance of the order will have no effect on other sales.

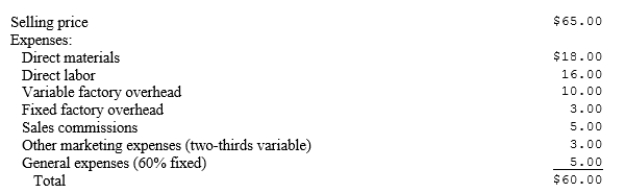

The company is now operating at 80 percent of capacity, or 80,000 units, and expects to continue at this level for the coming year without the Canadian order. Unit costs based on estimated actual capacity for the coming year include:  Prepare an analysis showing the effect on profits if the special order is accepted by the company. Based on your analysis, should the order be filled, and why?

Prepare an analysis showing the effect on profits if the special order is accepted by the company. Based on your analysis, should the order be filled, and why?

Correct Answer:

Verified

The order would be likely turned down i...

The order would be likely turned down i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: The practice of accepting a selling price

Q31: Tress Enterprises manufactures shampoo and conditioner. Last

Q32: Nolan Company has two segments: Audio and

Q33: Consider the Marshall Company's segment analysis: <img

Q35: Net income reported under absorption costing will

Q37: Bradley Inc. has the capacity to make

Q38: The Blue Saints Band is holding a

Q39: The excess of revenue over variable costs,

Q40: The Company is planning to sell Product

Q43: The difference in cost between two alternatives,such