Essay

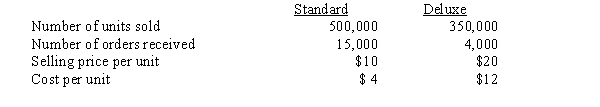

Hoctor Industries wishes to determine the profitability of its products and asks the cost accountant to make a comparative analysis of sales, cost of sales and distribution costs of each product for the year. The accountant gathers the following information which will be useful in preparing the analysis:  Advertising expenses total $100,000, with 60% being expended to advertise the Deluxe model. The representatives commissions are 5% and 7% for the standard and deluxe models, respectively. The sales manager's salary of $50,000 is allocated evenly between products. Other miscellaneous selling costs are estimated to be $6 per order received.

Advertising expenses total $100,000, with 60% being expended to advertise the Deluxe model. The representatives commissions are 5% and 7% for the standard and deluxe models, respectively. The sales manager's salary of $50,000 is allocated evenly between products. Other miscellaneous selling costs are estimated to be $6 per order received.

(a) Compute the selling cost per unit.

(b) Prepare an analysis for Hoctor Industries that will show in comparative form the income derived from the sale of each unit for the year.

Correct Answer:

Verified

(a)

(b)

(b)

Hoctor Ind...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Hoctor Ind...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Mobile, Inc., manufactured 700 units of Product

Q4: The basic assumption made in a variable

Q5: The Blue Saints Band is holding a

Q8: Consider the income statement for Pickbury Farm:

Q9: Consider the income statement for Pickbury Farm:

Q10: Sherpa Manufacturing has the following income statement

Q14: Nolan Company has two segments: Audio and

Q54: If the selling price and the variable

Q55: Which of the following would cause the

Q74: A company increased the selling price for