Multiple Choice

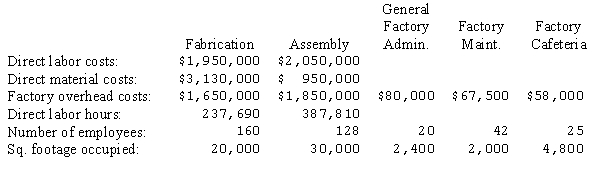

The Lucas Manufacturing Company has two production departments (fabrication and assembly) and three service departments (general factory administration, factory maintenance, and factory cafeteria) . A summary of costs and other data for each department, prior to allocation of service department costs for the year ended June 30, appears below: The costs of the general factory administration department, factory maintenance department, and factory cafeteria are allocated on the basis of direct labor hours, square footage occupied, and number of employees, respectively.  Assuming that Lucas elects to distribute service department costs to production departments using the direct distribution method, the amount of general factory administration department costs that would be allocated to the assembly department would be (round all final calculations to the nearest dollar) :

Assuming that Lucas elects to distribute service department costs to production departments using the direct distribution method, the amount of general factory administration department costs that would be allocated to the assembly department would be (round all final calculations to the nearest dollar) :

A) $30,400.

B) $25,650.

C) $0.

D) $49,600.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Factory overhead:<br>A)Can be a variable cost or

Q28: The entry to apply factory overhead to

Q36: Venus Company has developed the following flexible

Q37: Costs that vary in proportion to direct

Q39: The method of distributing service department costs

Q42: Jarcly Manufacturing Company uses activity-based costing. The

Q45: A cost driver is:<br>A)An overhead or activity

Q58: Factory overhead includes:<br>A)Indirect labor but not indirect

Q63: The following are the results of the

Q64: When preparing a flexible budget for factory