Short Answer

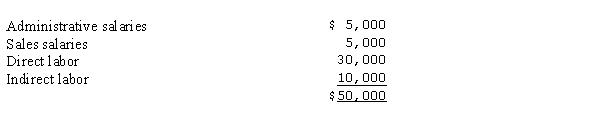

Harmony Company has accrued payroll costs of $50,000 for the period May 28 - 31 as follows:  Other Information: (a) The FICA rate is 8% of the first $100,000 of wages. None of the employees has reached this maximum.

Other Information: (a) The FICA rate is 8% of the first $100,000 of wages. None of the employees has reached this maximum.

(b) The company is responsible for state and federal unemployment taxes on the first $8,000 of wages. All of the employees have previously reached this maximum.

(c) Payroll taxes are spread over all jobs.

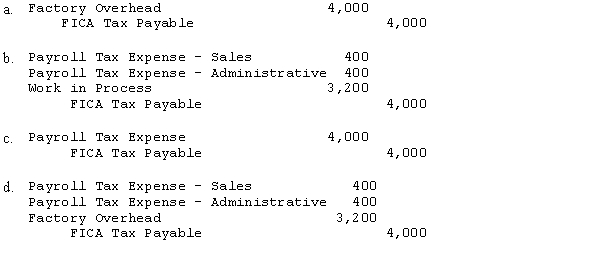

What entry would be necessary to accrue payroll taxes for the period of May 28 - 31?

Correct Answer:

Verified

D

Payroll tax expense - sales

5,000 x 8%...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Payroll tax expense - sales

5,000 x 8%...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: The payroll summary for EVB Inc. for

Q7: An employee regularly earns $12 per hour

Q8: A wage plan based solely on an

Q10: Under a modified wage plan, an employee

Q12: Payroll records for selected employees of Tomco

Q15: A direct laborer in a factory earns

Q16: Tyler Jacob is paid $15 per hour

Q18: Jay Vato works at Batwing Industries from

Q20: If the amount of overtime premium is

Q37: An accrued expense such as Wages Payable