Essay

The Tidle Manufacturing Company uses a job order cost system. Factory wages are paid on a straight hourly basis with indirect labor getting $8.50 an hour and direct labor getting $10.00 an hour.

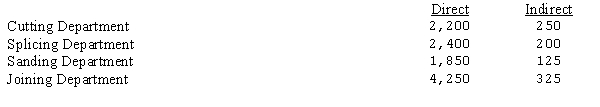

During the week of January 7, the following hours were worked:  Salaries and wages are paid weekly, with administrative salaries totaling $16,500 and salesperson's salaries totaling $12,200.

Salaries and wages are paid weekly, with administrative salaries totaling $16,500 and salesperson's salaries totaling $12,200.

The following deductions are to be considered:  Prepare journal entries to record:

Prepare journal entries to record:

a.The payroll.

b.The payment of the payroll.

c.The payroll distribution.

d.The employer's payroll tax expense.

Correct Answer:

Verified

*($107,000 + $7,650...

*($107,000 + $7,650...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: The departmental responsibilities of the payroll function

Q18: The Dehl Company payroll for the first

Q19: The payroll for the week ended January

Q21: Under a modified wage plan, Jim Phillips

Q22: All of the following personnel would be

Q24: Western Industries pays employees on a weekly

Q24: All of the following are characteristics of

Q25: At a plant where car doors were

Q26: Western Industries pays employees on a weekly

Q28: Daktari Enterprises' Schedule of Earnings and Payroll