Multiple Choice

Use the following information for questions.

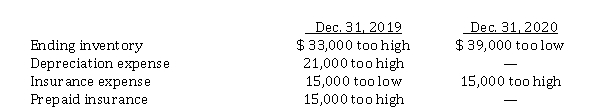

Fairfax Inc. began operations on January 1, 2019. Financial statements for 2019 and 2020 contained the following errors:  In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

-The total effect of the errors on Fairfax's 2020 net income is

A) understated by $ 94,200.

B) understated by $ 61,200.

C) overstated by $ 28,800.

D) overstated by $ 49,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Which of the following statements is correct?<br>A)

Q30: Use the following information for questions.<br>Fairfax Inc.

Q31: For accounting changes, which of the following

Q32: Explain economic consequences arguments relative to management

Q33: Accounting for a retrospective change requires<br>A) reissuing

Q35: Use the following information for questions.<br>Cheyenne Ltd.'s

Q36: Error corrections and adjustments<br>The controller for Stork

Q37: Which type of accounting change may be

Q38: An example of a correction of an

Q39: Use the following information for questions 25-26.<br>On