Multiple Choice

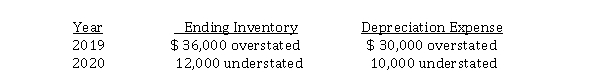

Eagle Corp. is a calendar-year corporation whose financial statements for 2019 and 2020 included errors as follows:  Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2019 or December 31, 2020. Ignoring income taxes, by how much should Eagle's retained earnings be retrospectively adjusted at January 1, 2021?

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2019 or December 31, 2020. Ignoring income taxes, by how much should Eagle's retained earnings be retrospectively adjusted at January 1, 2021?

A) $ 32,000 increase

B) $ 8,000 increase

C) $ 4,000 decrease

D) $ 2,000 increase

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Which of the following alternative accounting methods

Q19: Explain the circumstances in which an accounting

Q20: Retrospective application for accounting changes<br>Discuss how retrospective

Q21: Accounting for accounting changes and error corrections<br>Parrot

Q22: Use the following information for questions.<br>Cheyenne Ltd.'s

Q24: When a company decides to switch from

Q25: On January 1, 2017, Casino Inc. purchased

Q26: Use the following information for questions 30-31.<br>Major

Q27: Which of the following is NOT considered

Q28: On January 1, 2017, Missoula Corporation bought