Essay

Effects of errors on net income

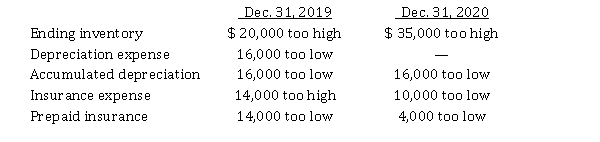

Hummingbird Corp. began operations on January 1, 2019. Financial statements for 2019 and 2020 contained the following errors:  In addition, on December 26, 2020, fully depreciated equipment was sold for $ 19,000, but the sale was not recorded until 2021. No corrections have been made for any of the errors.

In addition, on December 26, 2020, fully depreciated equipment was sold for $ 19,000, but the sale was not recorded until 2021. No corrections have been made for any of the errors.

Instructions

Ignoring income tax, show your calculation of the total effect of the errors on 2020 net income.

Correct Answer:

Verified

Note: The error in depreciat...

Note: The error in depreciat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Which of the following is NOT considered

Q44: Correction of errors in prior years<br>Goldfinch Inc.

Q45: Which of the following should be given

Q46: Under IFRS, which of the following disclosures

Q47: On January 1, 2020, Miner Corp. changed

Q49: One condition required by IFRS is that

Q50: Which of the following is NOT considered

Q51: Matching disclosures to situations<br>In the blank to

Q52: Explain how management should apply accounting policies

Q53: Explain the three types of accounting changes