Multiple Choice

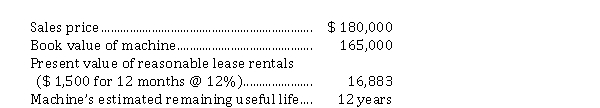

On December 31, 2020, Lewis Ltd. sold a machine to Martin Inc. and simultaneously leased it back for one year. Pertinent information at this date follows:  On Lewis's December 31, 2020 statement of financial position, the deferred profit from the sale of this machine should be reported as

On Lewis's December 31, 2020 statement of financial position, the deferred profit from the sale of this machine should be reported as

A) $ 17,000.

B) $ 15,000.

C) $ 2,000.

D) $ 0.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Capital lease amortization and journal entries<br>Erica Corp.,

Q5: When is a lease recognized as an

Q6: Rabbit Inc. has an asset with a

Q7: Initial measurement of right-of-use asset and lease

Q8: Under IFRS 16, the right-of-use lease requires

Q10: What type of lease is EXCLUDED from

Q11: ASPE revenue recognition tests<br>ASPE and IFRS have

Q12: On December 31, 2019, Northern Skies Corp.

Q13: Accounting for a capital lease by the

Q14: A sale-leaseback transaction is<br>A) a lease that