Multiple Choice

Use the following information for questions.

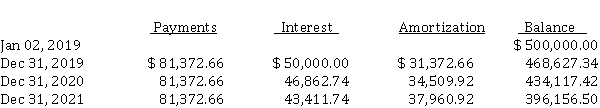

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

-What is the interest rate implicit in the amortization schedule presented above?

A) 12%

B) 10%

C) 8%

D) 6%

Correct Answer:

Verified

Correct Answer:

Verified

Q50: Under ASPE, if land is the sole

Q51: Calculation of lease amounts for lessor for

Q52: On January 1, 2020, Marlene Corp. enters

Q53: How do you distinguish between a manufacturer/dealer

Q54: Accounting for a direct financing lease by

Q56: Bargain purchase option<br>Star Company (a private company

Q57: Cary Corp. manufactures equipment for sale or

Q58: How many years do companies have to

Q59: Lessee and lessor accounting (sale-leaseback)<br>On January 1,

Q60: Sale-leaseback transactions<br>Why would a company enter into