Multiple Choice

Use the following information for questions.

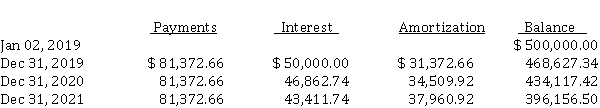

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

-The total lease-related expenses recognized by the lessee during 2020 are (rounded to the nearest dollar)

A) $ 76,863.

B) $ 80,000.

C) $ 81,373.

D) $ 91,863.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Leases with real estate<br>If Pink Inc. leased

Q19: When a lessee is accounting for a

Q20: Use the following information for questions 31-32.<br>On

Q21: On June 30, 2020, Sharma Corp. sold

Q22: Bourne Corporation has an asset with a

Q24: Operating leases for lessors<br>Discuss how lessors account

Q25: Lease criteria under IFRS 16<br>Discuss the criteria

Q26: In calculating depreciation of a leased asset,

Q27: In calculating the present value of the

Q28: Executory costs include<br>A) maintenance, interest and property