Multiple Choice

Use the following information for questions.

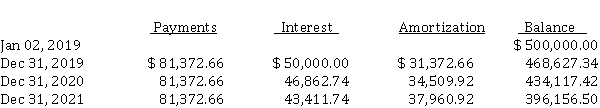

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

-What is the amount of the lessee's obligation to the lessor after the December 31, 2021 payment? (Round to the nearest dollar.)

A) $ 500,000

B) $ 468,627

C) $ 434,117

D) $ 396,157

Correct Answer:

Verified

Correct Answer:

Verified

Q113: A lessee reported a ten-year capital lease

Q114: Under ASPE, a lease in which the

Q115: On January 1, 2020, Jeckyll Ltd. signs

Q116: On December 1, 2020, Greens Corp. leased

Q117: In Canada, lessors are usually these following

Q119: Which item is NOT included in amount

Q120: Lease A does not contain a bargain

Q121: Lessor accounting-lease with IFRS criteria<br>On January 1,

Q122: Differences between ASPE and IFRS 16<br>Discuss the

Q123: Use the following information for questions.<br>Ball Ltd.