Multiple Choice

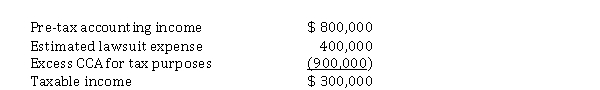

At the end of 2020, its first year of operations, Kali Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $ 400,000 will be deductible in 2021 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $ 300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

The estimated lawsuit expense of $ 400,000 will be deductible in 2021 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $ 300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

A) $ 0.

B) $ 75,000.

C) $ 150,000.

D) $ 200,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q52: Change in tax rates<br>Vansatia Construction Inc. uses

Q53: On January 1, 2020, Wings Inc. purchased

Q54: A reconciliation of Quebec Corp.'s pre-tax

Q55: Under IFRS, how are deferred tax asset

Q56: Comprehensive income tax situation with multiple differences

Q58: Deferred tax asset<br>a) Describe a deferred tax

Q59: Recognition of tax benefits in a loss

Q60: Taxable temporary difference<br>Explain what a taxable temporary

Q61: Under IFRS, end of the period adjustments

Q62: Saucy Inc. reported a taxable and