Short Answer

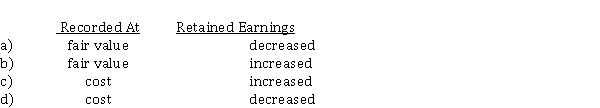

Emily Corp. owned shares in Carr Ltd. On December 1, 2020, Emily declared and distributed a property dividend of Carr shares when their fair value exceeded the carrying amount. As a consequence of the dividend declaration and distribution, the accounting effects would be Property Dividends

Correct Answer:

Verified

Correct Answer:

Verified

Q55: On June 30, 2020, when Wenn Inc.'s

Q56: Dividend distribution<br>You have recently been appointed CEO

Q57: On July 1, 2020, Nehan Corp. issued

Q58: The preemptive right enables a shareholder to<br>A)

Q59: Eye Corp. owned 20,000 shares of Lash

Q61: Share subscriptions<br>On April 28, 2020, Sweden Inc.

Q62: Aye Corp. was organized in January 2020

Q63: According to the CBCA, when a company

Q64: The fair value of a property dividend

Q65: Dividends on preferred shares<br>At December 31, 2020,