Multiple Choice

Use the following information for questions.

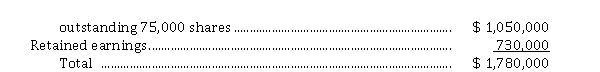

Galba Corp.'s shareholders' equity at January 1, 2020 was:

Common shares, no par value; authorized 200,000 shares;  During 2020, Galba had the following share transactions:

During 2020, Galba had the following share transactions:

Acquired 2,000 treasury shares for $ 30,000

Sold 1,200 treasury shares at $ 19 a share

Retired the remaining treasury shares

No other share transactions occurred during 2020.

-Instead, assume Galba cancelled the 2,000 shares when it acquired them for $ 30,000. The journal entry to record the retirement would be

A) Dr. Common Shares, $ 30,000; Cr. Cash, $ 30,000.

B) Dr. Treasury Shares, $ 30,000; Cr. Cash, $ 30,000.

C) Dr. Common Shares, $ 28,000; Dr. Contributed Surplus, $ 2,000; Cr. Cash, $ 30,000.

D) Dr. Common Shares, $ 28,000; Dr. Retained Earnings, $ 2,000; Cr. Cash, $ 30,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: If a corporation wishes to "capitalize" part

Q2: In jurisdictions where par value shares are

Q3: What are the three basic or inherent

Q4: A feature common to both stock splits

Q5: The residual interest in a corporation belongs

Q7: Gupta Corp. purchased its own shares on

Q8: On December 1, 2020, Dee Ltd. agreed

Q9: As a minimum, how large in relation

Q10: A dividend which is a return to

Q11: A corporation declared a dividend, a portion