Essay

Share retirement and stock dividends

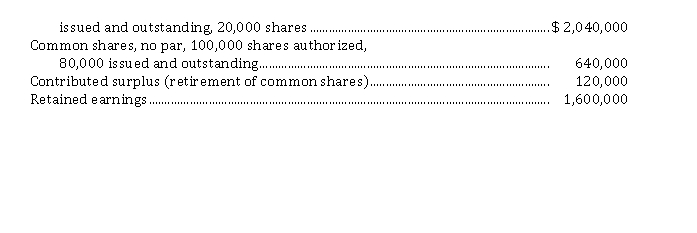

Sudan Enterprises Inc. reported the following shareholder's equity at December 31, 2019:

Contributed Capital

Preferred shares, $ 1, no par value, 100,000 shares authorized, cumulative,

callable at $ 107 plus dividends in arrears;  The following transactions took place in 2020:

The following transactions took place in 2020:

Jan 20 Redeemed 1,000 preferred shares at the call price. There were no dividends in arrears.

Jan 28 Declared $ 100,000 in dividends. Use separate accounts for each class of dividends.

Feb 28 Retired 8,000 common shares at $ 12 per share.

Mar 2 Declared and distributed a 3% common stock dividend. The market value of the shares at that time was $ 11.50.

Instructions

Prepare journal entries for the 2020 transactions.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Use the following information for questions 74-76.<br>Instanbul

Q22: Kryer Ltd. has 50,000 no par value

Q23: Use the following information for questions.<br>At December

Q24: Use the following information for questions.<br>When Oslo

Q25: While corporations have varied reasons for purchasing

Q27: Stockholm Corp. was organized on January 1,

Q28: On January 1, 2020, when the market

Q29: An investment in marketable securities was distributed

Q30: Nicosia Corp. was organized on January 1,

Q31: Sofia Ltd. reported net income of $