Essay

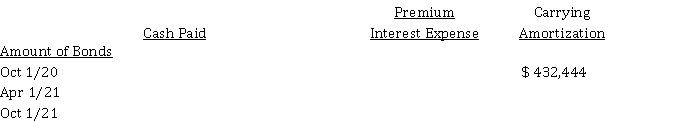

On October 1, 2020, Whitfield Corp. issued $ 400,000 10% bonds, due on on October 1, 2025. Interest is to be paid semi-annually on April 1 and October 1. The bonds were sold to yield 8% effective annual interest. Whitfield has a calendar year end.

Instructions

a) Complete the following amortization schedule for the dates indicated. Round all answers to the nearest dollar. Use the effective-interest method.

b) Prepare the adjusting entry required for these bonds at December 31, 2021.

c) Calculate the interest expense to be reported in the income statement for the year ended December 31, 2021.

Correct Answer:

Verified

Correct Answer:

Verified

Q49: Note issued for cash and other rights<br>Rebecca

Q50: When the effective-interest method is used to

Q51: Fair value option<br>Explain the fair value option

Q52: Under ASPE, if a debt refunding is

Q53: Use the following information for questions 44-46.<br>On

Q55: Accounting for bond issuance and retirement<br>Twilight Corp.

Q57: Retirement of bonds<br>On December 31, 2019, LaBrea

Q58: Bond accounting, ratios, debt covenants<br>Superior Equipment Corporation

Q59: On January 1, 2020, Neeson Ltd. issued

Q67: If bonds are issued between interest dates,